This is essay 5of 7 essays for The Tech Progressive Writing Challenge. Join the conversation in the build_ Discord.

We’ve spent the last few months so focused on the metaverse that we’ve taken our eyes away from the developments we’ve made in the OG metaverse: the universe.

Space-for-earth has been a large industry for a while. Use-cases such as telecommunications, national security, and observation can be defined as space-for-earth. These account for 95% of space sector revenues at $366bn. Meanwhile, space-for-space has struggled to grow until the last decade. This can be defined as space mining, space habitation, and space refuelling.

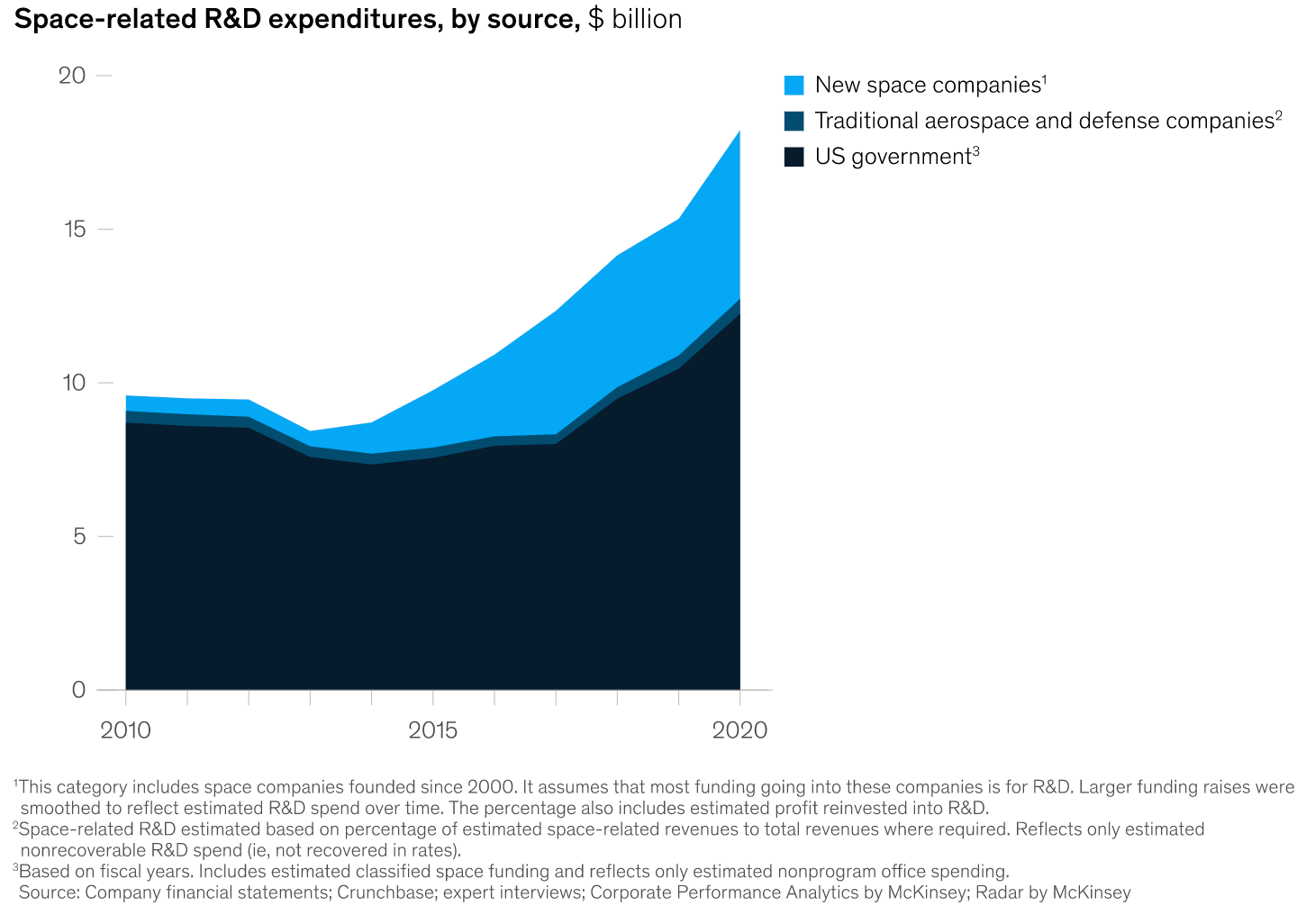

Commercial investment in space-for-space has gone up from $1bn to ~$8bn in space funding in 2021.

Though the absolute commercial investment is lower than the $12bn annual US government investment, the growth rate for commercial investment is accelerating. $8bn in commercial investment is about already higher than the annual Chinese government expenditure on space at $5.8bn. Given the Chinese space program is second in spend to only the US, this is an impressive growth in commercial investment.

SPACS have been a large cause for the commercial growth in the space. Rocket Lab, Spire, and Virgin Galactic all underwent SPAC deals from 2020-2021. These have given space companies liquidity via early access to public markets, but have also pushed up valuation multiples.

Increased investment can also be attributed to two of the most influential entrepreneurs in the world: Elon Musk and Jeff Bezos.

They founded SpaceX and Blue Origin respectively and are both seeking to develop their own multibillion enterprise via commercial space travel. With the PR machine these men bring, popular awareness has skyrocketed. SpaceX doubled their instagram followers to 18M between 2020-2021, while 150K people gathered in Florida to watch the SpaceX astronaut launch.

For all of the SPAC hype and popular coverage, there are also some core commercial applications that are drawing attention. As a few examples:

Space mining. Near-Earth Asteroids are rich in metals such as nickel, iron, platinum, and rare earth elements (REE). NASA estimates that there are 80K+ objects in the Asteroid Belt > 1km in diameter. The extracted metal value has been predicted at $100 quadrillion. Even just a tiny share of this will fuel Earth’s growing demand for raw materials - especially REE - and create many trillion dollar companies. More importantly, it will also be able to sell products to other space industries. Water is particularly valuable in space: it can protect against radiation, be consumed, and be converted to hydrogen for fuel.

Space habitation. Space mining will allow us to build space stations - and then space cities - at a more affordable cost. If the Earth becomes uninhabitable due to climate change or warfare, then space cities will be the only path forward for human civilisation. How the commercial model will work for these is to be defined. Will citizens become consumers of space businesses, paying subscriptions instead of taxes? Or will the nation state continue to operate outside of Earth?

Space tourism. From $250K for a 2-hour flight to $55m for a 10-day voyage, the price is representative of the desire to explore space as the frontier. These prices will limit it to the rich but do not block it from becoming an $8bn industry by 2030.

Space is full of the unknown unknowns. It is the next frontier for humanity to traverse as we seek to become a Type 1 civilisation. Commercial investment only seems to be accelerating the opportunities, but now we need to focus on executing against the vision.

Further reading:

A Beginners Guide to European Tech, Sifted, 2021

The Commercial Space Age is Here, Harvard Business Review, 2021